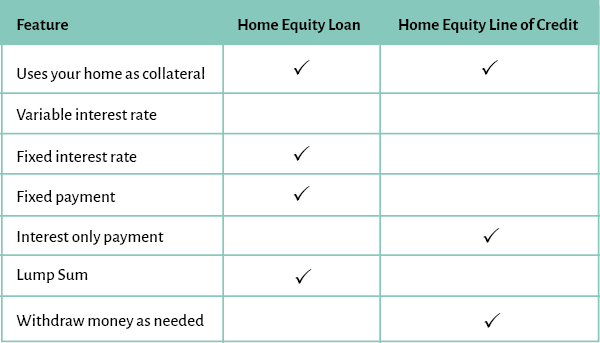

heloc vs home equity loan which is better? Homeowners who need to tap into the equity in their home often choose between two options: A Home Equity Line of Credit or a Home Equity Loan. Both options let you tap into the equity of your house, but each has its own features and considerations.

We will examine the differences between HELOCs, and home equity loans in this article and give you some insights to help make an informed choice.

heloc vs home equity loan which is better?

Your financial situation and other factors will determine whether you choose a HELOC or a home equity line of credit. Here are a few key considerations.

Goals and Needs:

| HELOC | Home Equity Loan |

|---|---|

| A HELOC is a better option if you need to access funds regularly for multiple expenses. | A home equity loan may be the best option if you need to pay for a one-time cost or consolidate debt. Preferences for interest rates |

| A HELOC offers greater flexibility if you like the idea of borrowing and repaying funds when needed. | A home equity loan might be a better option for you if you prefer a repayment plan that is structured and has a set term. Future financial planning: |

| A HELOC may be more flexible if you are willing to accept rate fluctuations, and plan on paying the debt off quickly. Flexible borrowing and repayment: |

A home equity loan that has a fixed rate of interest is the best option if you want predictability and stability. |

Take into consideration your financial security and long-term goals. Consider your future income and expenses.

Home Equity Loans and HELOC: FAQ

What is a HELOC?

A HELOC allows you to borrow money against your equity. It works like a credit card. You have a limit on your credit and you can borrow funds and pay them back as necessary.

What is a Home Equity Loan?

Home equity loans, or second mortgages, are lump-sum loans that are backed by the equity of your home. The full amount of the loan is received upfront, and you make monthly payments at a fixed rate.

What are the differences in interest rates between a HELOC or a home equity loan?

HELOCs have variable rates, which fluctuate based on the market over time. Home equity loans offer fixed rates of interest, which provides predictability and stability in monthly payments.

What are the benefits of a HELOC?

HELOCs are flexible, as they allow you to borrow what you need and when you need it. The flexibility of the HELOC allows you to borrow multiple times within the draw period. This is ideal for ongoing or unexpected expenses. You only pay interest for the amount borrowed, not your entire credit limit.

What are the benefits of a home equity loans?

Home equity loans offer a lump-sum upfront that can be used for one-time large expenses or to consolidate debt. You can plan your finances easier with a fixed rate of interest. Home equity loans have longer repayment periods than HELOCs.

What are some of the possible drawbacks to a HELOC?

A HELOC can have a variable interest rate that increases over time. This will result in higher monthly payments. HELOCs have a draw-period followed by a period of repayment, so be ready for the change from borrowing to repaying.

What are some of the possible drawbacks to a home equity line of credit?

Since you get a lump-sum, a home equity loan might not be as flexible as a HELOC. You may have to pay interest on funds you do not use. If you decide to sell your house before paying off the loan, it will be due along with any mortgage balance.

What is the difference between home equity and home equity line of credit?

Home equity loans offer borrowers a lump-sum with a fixed interest rate, but the rates are usually higher.

HELOCs offer cash as needed, but the interest rate can be fluctuating.

heloc vs home equity loan which is better? :-Video

conclusion

Both HELOCs (home equity loans) and home equity loan provide access to your equity, but each has its own features and considerations. HELOCs are flexible and provide ongoing access to money, so they can be used for a variety of expenses.

Home equity loans are available in a lump-sum amount with fixed rates of interest, which makes them perfect for one-time expenses or debt consolidation. To determine the best option for you, consider your financial goals, your interest rate preferences and your borrowing and repayment flexibility. A financial advisor can provide guidance on the best decision.

Both HELOCs (home equity lines of credit) and home equity loans leverage your home as collateral. It’s important to consider carefully your ability to repay borrowed funds, and to understand the risks involved.

Do visit Finance category.

Frequently Asked Questions (FAQ):-

Is HELOC the same as home equity loan?

No, a Home Equity Line of Credit (HELOC) is not the same as a home equity loan, although they both involve borrowing against the equity in your home

Is a HELOC cheaper than a loan?

Home Equity Line of Credits (HELOCs) and home equity loans can differ in cost depending on a number of factors including interest rates, fees and repayment terms.

Is HELOC good or bad?

HELOCs can be beneficial if they are used responsibly. They provide flexibility and lower upfront fees. It can be a bad thing if it is misused, or if the variable interest rate increases, resulting in higher borrowing costs, and the risk of losing your home.